Growing up I can’t even count how many times I heard that “money is the root of all evil”! People that had a bunch of money were labeled as selfish, cold hearted, manipulative…you name it. Throughout my childhood I saw some of my closest family members, including my mom, struggle with, and fear money. I always wondered; “what makes money so scary”?

Well I’ve found that we’re the ones that make it scary. I mean today with bitcoin and online payments it’s even more evident that the concept of money is only what we make it in our minds. It’s kinda like in The Matrix, Neo didn’t believe that the world he thought he lived in wasn’t real, and neither did I, until I learned…

1. What NOT to Spend Money On

This was one of the hardest things for me to learn. As a teenager money was a small price to pay for popular opinion. In the school I went to, if you had the Grant Hill Filas with the patent leather and the pistons jersey to match, “you were doin’ it”! Me and my friends were so determined to shine that we would share and take turns wearing certain outfits to school!

I didn’t know what it was back then, but now I realize that the satisfaction I got from wearing a jersey that my friend forgot to wash the week prior came from how people looked at me. Maybe they thought I was cool, or had money, or could play ball; but paying for that opinion was a priority for me. Today I see the same mindset in some people and it drives me to try and help where I can.

These days I ask myself whether or not someone else’s opinion is still a priority to me whenever I buy something…just on a bigger scale. Do I have this car just so other people that see it on he street will think of me in a certain way? Did I buy this new phone because I needed it, or so I could be one of the first of my clique to have it?

It all comes back to liabilities…things that cost you money. If you have that new phone so you can keep up with your online business cool, that’s awesome! But if not, could you have used that money to make yourself more money? You may have to fork over a few cool points (which actually do have monetary value if you use them right) but you make so much more on the back end!

Before each and every purchase I ask myself, “is this purchase getting me closer to my goals”? One of my goals is to not have to depend on a 9-5 job for money. If what I’m looking at buying in a store or online doesn’t help me with my goals, why buy it?

So if you have goals similar to mine, what should you buy???

2. How to Create Passive Income Streams

Creating passive income is one of the keys to maximizing wealth and minimizing stress. Oh man, when I think back to how much trust and faith I put into working for someone else, it makes me sick!

Maybe it’s my nature (and probably yours too if you’re reading this) but I NEED to be independent.

I don’t want to rely on anyone for my livelihood. I used to think that just getting a good stable job with good benefits was all I needed. Let’s be clear, there’s nothing wrong with that stable job, but the truth is that it’s probably a lot less stable then you think.

I don’t say that to scare anyone, but I feel a duty to inform people of counterproductive views that I held myself not too long ago. I’ve always been a hustler, I think that’s what Virginia is for right?!?!

My hustling in the past was piecemeal…here and there…come and go…and I had to put in massive amounts of precious time and effort.

Look at it like this, you know that option for your bills to get taken out automatically that we don’t like to use because they may overdraft your account if you don’t have it? Instead of bills, think of setting up automatic systems that pay you instead of pull money out of your account!

Keep your good job, that’s cool but don’t get comfortable!

Nothing is guaranteed!

Set up systems that pay you while you sleep! This way if anything goes wrong at that job that nothing can go wrong at, you’ll have a net to catch you.

Examples of passive income streams vary and I’ll get more in-depth in another post but some with the lowest overhead costs are:

–Flipping items from garage sales by selling them on eBay

You may spend a little money to get started in these but remember, something that makes you money, like one of these income streams, is an asset. All of these examples take a little work but once they’re up and running properly you can make a killing while you’re at your 9-5!

3. How to Handle Debt

Something I found out as I got older that relates to money, and so many other aspects of life, is that humans fear what we don’t understand. Most of us weren’t raised to understand wealth, and as a result we have a less than perfect view of money and what to do with it.

Watching my mom cry over bills as a kid made me hate money. As I got older that hatred stuck with me; but instead of avoiding what I hated I would just get paid on Friday and be broke by Sunday (if I was lucky). I couldn’t spend fast enough and when it was gone I borrowed it from someone else.

Even if your experience with money isn’t as drastic as mine I know you can relate. My mission is to give everyone reading this the tools to be wealthy that are normally buried in books, talks, and online content.

Jim Collins says in his book, Good to Great that good is the enemy of great. I take this to mean that if you get comfortable, you’ll never reach your full potential. If you don’t have money problems, awesome…now build passive income streams. If you have passive income, awesome…now build a business you’re passionate in.

There’s always a next step…move forward!

Some of you may have heard of the money guru Dave Ramsey. Basically he’s a stickler for debt; he hates it! Debt can be horrible if used incorrectly but in Dave’s case his hatred is similar to how mine was. Dave hates debt because he got into real estate in his 20’s and lost a bunch of money. I hated debt because it made my mom cry. These are two emotional reactions.

When it comes to debt and money in general leave emotion out of the equation. I know you’re thinking “easier said then done” and you’re right, but do it anyway.

Debt is money you eventually need to pay back to the person or business that loaned you the money.

If you carry debt in credit cards that should be the first thing to go. I say this because with interest you can end up paying and paying and never seeing the balance drop (I’ve been there)! If you don’t have credit card debt don’t cut up your cards but make sure you pay them off every month.

Changing your spending habits and setting up passive (or additional active) income streams will help you pay down debt. Grind!

Live like no one else now, so you can live like no one else later!

Car debt is another killer. Get the lowest possible payment you can on a car unless you can buy it in cash. Cars suck up so much money and are, for the most part, a purely emotional purchase…do you really need a $400 a month payment for a car that bleeds your hard earned dollars?

Real estate is one area that I’m familiar with in which you can leverage your debt to work for you. This isn’t the simplest thing to do but I say this to make the point that not all debt is horrible.

Even if you own a home, if it isn’t making you money through renters, it’s still a liability. Building up equity (percentage of ownership) in real estate coupled with eliminating useless debt, will both lead to you being wealthier in the big picture.

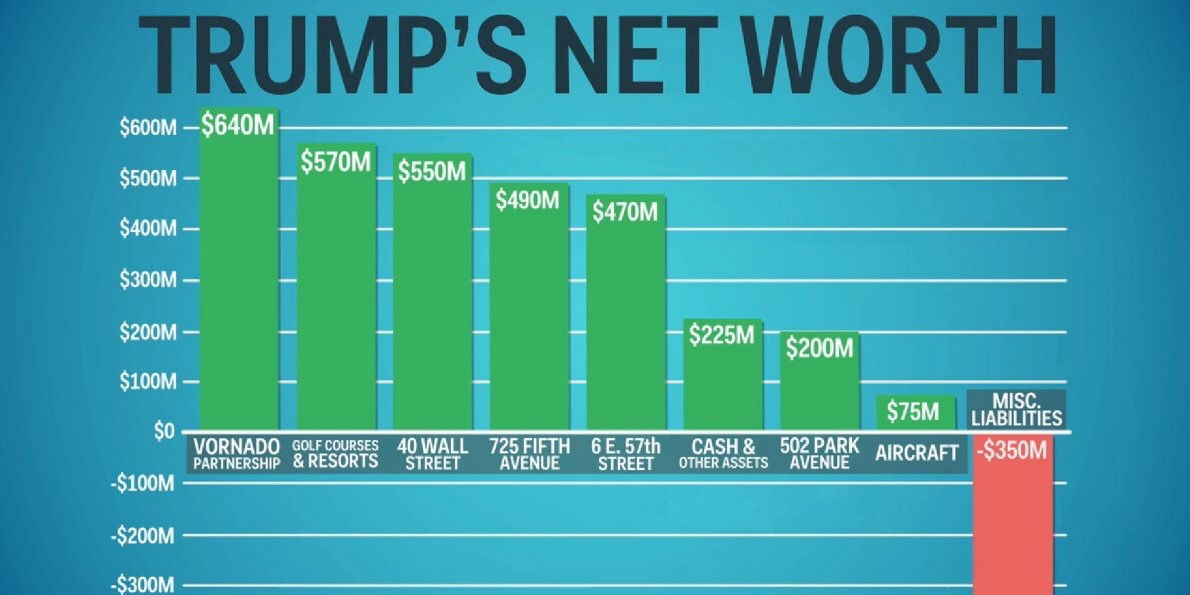

4. How to Calculate Net Worth

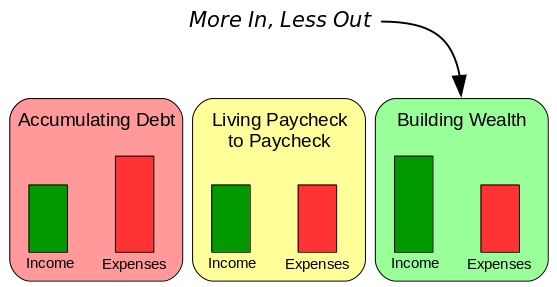

So we know an asset makes you money and a liability costs you money. So what is net worth?

Net worth is the the amount by which assets exceed liabilities. Here are some simple examples:

1. If I have $100k in the bank, live in a box under the overpass with only the clothes on my back, my net worth is $100k.

2.If I purchase a house in cash for $50k my net worth is still $100k because I have 100% ownership of the house worth $50k and $50k left in the bank.

3. If the value of the house goes up $25k my new net worth is $125k because I still have $50k in the bank plus now the house is worth $75k.

4. If the home value drops from $50k to $25k my net worth drops to $75k because I have $50k in the bank but now the house is only worth $25k.

If I add in debt totaling $20k to scenario number 2 I would have to subtract that $20k from my net worth number of $100k leaving me with $80k.

So if you have $25k in the bank but a $45k car loan you’re sitting at a negative net worth.

Ultimately your net worth is the value of what you have minus the amount of debt you carry.

A lot of people I come across have at least a $30k car loan, $5k in credit card debt, and maybe a couple thousand dollars in the bank. Some have a $250k mortgage on top of that.

If that’s you I’m here to tell you, it’s ok that you got to that party and started taking Fireball Shots, but I want to help you get home before you blackout in someone’s living room!

5. Health is Wealth

You can’t take it with you. Investing in your health and longevity is one of the most important things you can do. You severely limit your capacity to make money if you’re not mentally and physically healthy.

When you have your health your mind is able to work at its full capacity. How productive do you feel after eating pizza? Now compare that to eating a healthier option. There is no comparison. We need to stop giving ourselves passes for abusing our bodies and minds with so called “food and drink”.

Any billionaire will tell you that taking care of your health is paramount. Building wealth takes action, motivation, and drive. Taking care of yourself makes accomplishing your goals so much easier. Also, it’s cheaper to eat healthy!

Preparing your meals in advance and buying in bulk saves you money. Period. Look at what you spend in fast food and groceries and think about whether or not you can do anything to lower those costs. Chances are you can lower them quite a bit.

Take a little extra time and effort, health is your most vital asset, there’s no way you can make money without it!

Gentrifanatic was established to make options available that may have not been emphasized for people that grew up like I did. This transcends to wealth, fitness, and diet. Before acting on any spectacular goals of achieving wealth be sure to invest in yourself first!

Any questions? I’ll be around, just hmu…

Pingback: 4 Easy Ideas in 2018 To Help You Cure the "Working For Someone Else Until You Die" Syndrome - Gentrifanatic