The best investment on earth is earth. – Louis Glickman

Gentrifanatics!

Welcome to yet another information packed edition of Gentrifanatic. This is the blog that makes information on Wealth, Health, and Wellness, available to the masses!

It seems like everyone I talk to about real estate investing is scared because they think real estate is a money pit. To that I say, it can be…if you don’t know what you’re doing.

I’m sure you’ll agree that it can be daunting to get into real estate investing. There is a lot to learn and a lot of potential to make mistakes.

On one of my first deals I bought a house without considering any factors other than what my mortgage would be versus how much I could get in rent. Because of this mistake I paid too much for a house that wasn’t going to give me a great return.

This can be dangerous. You can lose money if you don’t do your homework.

I still own that house and when something goes wrong the cash flow goes out the window! For instance, I recently had to purchase a new hot water heater which depleted the reserves that I had saved up from the cash flow!

Needless to say after that purchase I started paying more attention to the properties I invested in. Today all of my other properties get a positive flow of cash each month after all operating expenses. Also, my personal home has the potential to do the same if I ever choose to rent it out because of the factors I considered when buying.

In this post you’ll learn six critical things you must look for when making an investment purchase. If you follow these guidelines your likelihood for profit will skyrocket!

1. Location

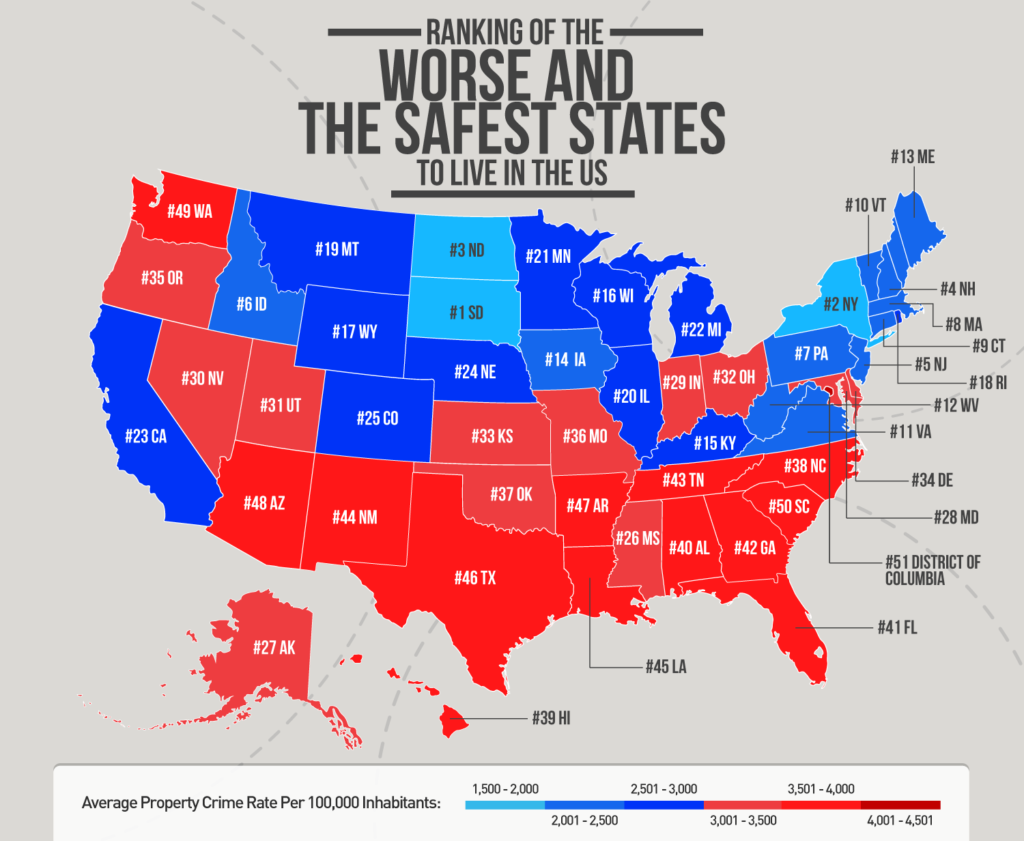

Don’t buy in a neighborhood you’re not comfortable in. Checking crime statistics is a no brainer.

Also make sure you check out the area at night. Maybe you didn’t notice that strip club around the corner playing music until 3AM (or maybe you did)!

Lattè Factor

Curb Appeal

Getting Around

Market Trends

2. Property Condition

A common saying in real estate investing is that you should buy the worst house in the best neighborhood.

3. Purchase Price

Find off market deals if you can.

Call up your local property manager and ask them who’s feed up with being a landlord. Call that person and make them an offer on their property!

4. Interest Rate

When starting out make sure you go with fixed interest rates. These rates stay the same for the life of your loan.

Say you buy a property for $150k and you put 25% down (standard for investment properties).

If you have a 3.5% interest rate your mortgage payments should be about $815 per month. If you boost that interest rate to just 5% you’ll be paying more like $930 per month. That’s an extra hundred per month in cash flow down the drain!

5. Taxes

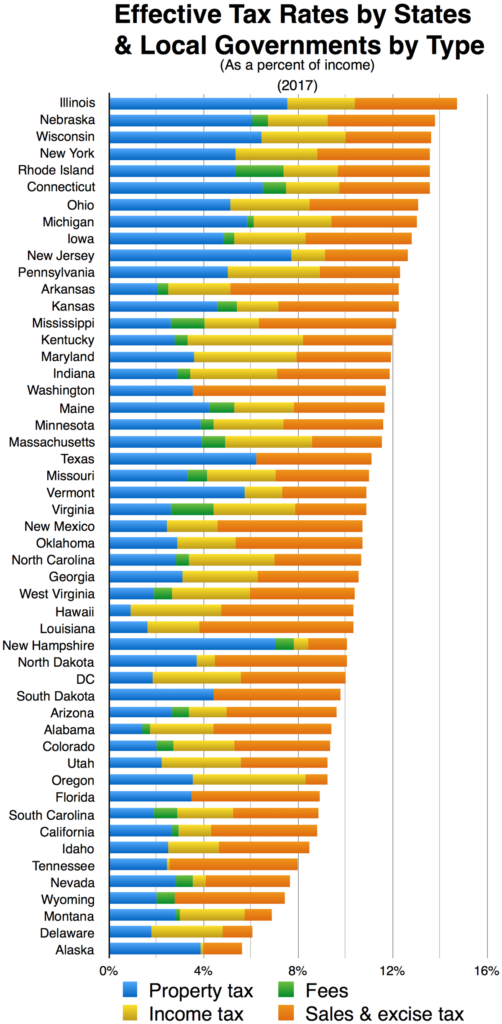

Similar to interest rates, if you buy in an area with high taxes you will see your cash flow dwindle.

These states have the lowest effective tax rates:

- Hawaii (.32%)

- Alabama (.48%)

- Colorado (.52%)

- Tennessee (.54%)

- Delaware (.56%)

These states have the highest effective tax rates:

- New Jersey (2.31%)

- Illinois (2.13%)

- Texas (2.06%)

- New Hampshire (2.03%)

- Vermont (2.02%)

Whatever you pay in property tax is considered part of your expenses for operating that property as a rental unit.

6. Operating Expenses

Along with property tax which we covered in number 5, this also includes insurance, property management , maintenance, capital expenditures, and hoa/condo fees.

Insurance

Insurance is a must have for any investment property. If anything happens to that property or anyone in it you can be held liable as the owner.

Lots of things can impact insurance rates. Shop around before you buy and make sure if covers everything you need protected.

Property Management

I know, you’re gonna manage the property yourself. Why would you need to account for property management?

There may come a day where you don’t want to, or can’t manage the property. If that day comes you’ll have already accounted for the drop in cash flow.

If you manage your own property make sure it will still cash flow positive if you have to pay a property management company one day.

A good rule for this is to allot 10% of the projected rent to property management.

Maintenance

Maintenance can be anything that routinely needs servicing. For example, you need to get a homes

HVAC serviced periodically. You may also need the chimney looked at, landscaping, powerwashing, gutter cleaning…you get the point.

You should allot 10% of the rent for maintenance as well when analyzing whether or not a property will cash flow.

Capital Expenditures

This operating expense deals with big ticket items. These will be things like getting a new roof or a new HVAC system. These items can put a serious dent in your profits if you don’t plan for them. A good conservative estimate is 10% of the rent once again.

Vacancy

While it’s not really an operating expense you should also account for how often your property will be vacant. This is arguably the most important thing you should factor in to your costs.

When the property is vacant you’re still responsible for the mortgage, taxes, insurance, and yes…even the utilities!

You’ll want to add another 10% of the rent to account for vacancy.

All together that’s 40% of your rental income just for operating expenses. Of course you don’t have to use 10% for each of these categories. This is just a conservative starting point.

Each deal and market is different. Know your market and your consumers and adjust accordingly if you need to.

Finale

Granted, it sounds like there are a lot of things that will just kill your cash flow. This is why really good deals can be really hard to find! You almost certainly won’t find them using regular real estate finding websites unless you can negotiate the price down.

Trust me. If you take these factors into account when buying your investment property or even a property you’ll be living in (which is an investment) you’re likely to come out a lot better than if you didn’t.

I’d love to hear your success stories or help you analyze a deal.