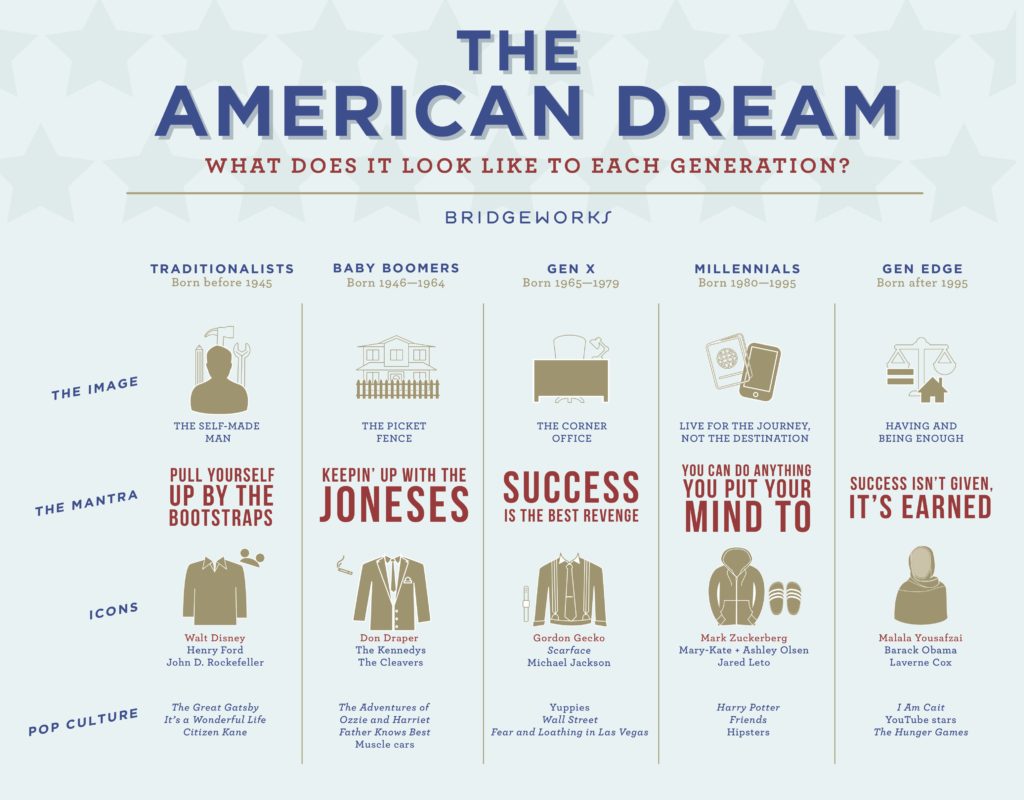

The American Dream is one of success, home ownership, college education for one’s children, and a secure job to provide these and other goals.

-Leonard Boswell

Welcome Gentrifanatics!

Let me start off by saying that I almost 100% DISAGREE with the quote above! I used this quote because in my opinion this is what most people think the term “American Dream” represents.

I’m sure you’ve heard, or even been taught this version of the American Dream:

Step #1: Graduate high school and get into a good college

Step #2: Graduate college and get a job with a good starting salary and room for growth

Step #3: Find your significant other and get married

Step #4: Buy your “forever house”

Step #5: Have 2.4 children

Step #6: Get promotions and save for retirement

Step #7: Retire at 65 and live out your remaining days in a rocking chair

Step #8: Die at 78.6 years old (if you were living the Japanese dream you could do it until you’re 83.7)!

You’ll have to agree that this path, or something very similar, has been pitched to you at some point in your life. But should this be your dream? Is this your dream?

At one point I really thought that the steps above were the American dream that I wanted.

I did graduate high school but I didn’t get into (or even apply to) any colleges. On top of that I went to one of the lowest rated high schools in the city where I grew up. There was pretty regular violence along with gangs, and guns (in fact some of these words were used in the schools nickname)!

College wasn’t really pushed in my school. At least not to me (I’ll have to unpack that with my therapist and get back to you)!

My mom was always working long hours. It was just me and her so she did what she had to do and she did a great job! I’m sure she mentioned college to me a few times but I don’t remember it being a priority. It could quite possibly be because I was too hardheaded at the time to listen!

Regardless, a four year degree wasn’t pushed on me in school or at home.

What was pushed on me is the military.

This may be the case at most high schools that cater to lower middle class and poverty level kids. It seems that the strategy is for the wealthy kids to go to great universities and get ready to take over America while the poorer kids go fight for it. Just my two cents and I’ll get more in depth on this later!

Straight after high school I went into the military. In no way am I badmouthing the time I spent in the military or the great people I met. It was a great experience for me.

After the military I had an entrepreneurial itch and I tested the water. Everyone told me I was crazy. They said I needed to get a stable job.

At this point I had already gotten married. Had a kid, and gotten divorced.

So a quick recap, I did half of step #1, skipped step #2 and went straight to step #3 and #5. But then I scratched out step #3 but kept step #5. Needless to say I wasn’t on what I thought was the normal path. I suspect that you’re able to identify to this path more than the steps that I laid out in order!

There was a lot of turmoil early on in my life. I’m sure a lot of you can relate to and even top my stories!

There is a light at the of your tunnel. Right now I haven’t reached mine but at least I can see it!

Finally I ended up getting a bachelor’s and a masters degree. They weren’t from the best school and I got them while I was working a full time job. I’m fortunate enough to have a job that pays well and investments that supplement my income quite a bit.

But I’d be a hypocrite if I told you that this came from hard work alone. I honestly don’t believe in hard work for hard work’s sake. Used to. Not anymore.

Too often we get caught up efficiently doing ineffective things

By doing effective things and continuing to progress I got to where I am today Effective things actually matter.

Just working hard so you look busy is the highest form of laziness!

In this post you’re going to hear me dissect different aspects of the American dream and their counterarguments. You can expect to gain a little bit of insight into how breaking away from the thinking that you were programmed to do can significantly change your life for the better.

…starting with learning…

College vs. The World

You may have already gone to college. If not you probably thought about it at one point. We’re programmed to think that college is a stepping stone to wealth. Do you think that’s the case?

Why do we go to college?

Earning Potential

Surely the first answer in recent history was to make more money. I’m not convinced that college will deliver this to you.

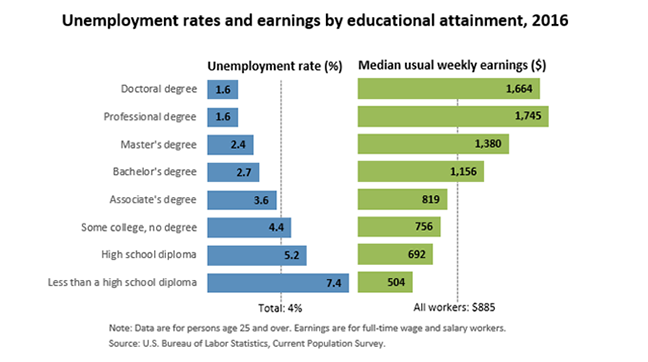

An argument for college set forth by the Bureau of Labor and Statistics is that in 2016 if you had a Bachelors degree you would earn $1,156 a week. Compare that to the $692 a week you’d be earning if you only had a high school diploma.

Seems convincing right?

What this data doesn’t take into account is effective learning outside of college. We all know that college costs a bunch of money. You either get someone else to give you the money, loan you the money, or you pay for it yourself.

Say you can get grants and scholarships by all means, pursue traditional colleges. Just know that much of the same information is out there for free. That’s what I mean by effective learning. Much of the knowledge you need to create something amazing today is already out there for free on the web. Why pay tens of thousands of dollars for someone to tell it to you?

Opportunity

It’s the same logic when it comes to the correlation between college and opportunity. In the chart above it shows that unemployment for people with a bachelors degree is only 2.7%. Those with only a high school diploma have an unemployment rate of 5.2%.

Here’s what I see. With instability in the job market you’re still very likely to be unemployed with a college degree. But say a high school grad and a college grad are both unemployed. Who do you think is in a better position?

Both the high school grad and the college grad have access to the same free, open source information. But the college grad probably has a bunch of student loan debt while the high school grad doesn’t.

Fear

Quick story

In the military I went through a special operations indoctrination. Our first day of this three day indoc (as they call it) was meant to break us. We got up super early and we had to do a bunch of running, pull ups, sit ups, and push ups. Then we had to run three miles to the pool on base.

Once we got to the pool we had to jump from a high diving platform in full gear with helmets and our rifle. We had to swim across the pool while holding a brick above our head…and a bunch of other stuff.

The last thing we did was treading water for 30 minutes (it felt like 2 hours). Not only were we treading water, there were about 20 of us and the cadre (instructors) pushed us all into the middle of the 20ft deep end of the pool.

Soon enough the weak swimmers started panicking. I was in the middle of all the guys and another guy started freaking out and grabbing on to me trying to keep himself afloat. All the while the cadre was swimming under us, pulling our legs down and dragging us underwater randomly.

Likely the first instinct is to panic. But if you panic you make poor decisions. When you make poor decisions you end up underwater.

Learn Yourself

This is where effective learning comes in. An idea of going to college is based on fear. It’s the fear that you won’t be able to be successful in your life if you don’t go to college. There’s the military of course but that’s not for everyone. Also since were trying to alleviate fear the military isn’t the best option!

Learn not only for yourself; butabout yourself.

Learn what your strengths are and then work toward them.

Find out about money management, accounting, marketing, sales, real estate, and anything else the real world runs on. Do it now. Do it while you don’t need to. Don’t go into serious debt in the hopes of getting your returns somewhere down the road.

Understand how to manage your money and live below your means so you won’t have to succumb to the fear of being unemployed.

Employee vs. Investor

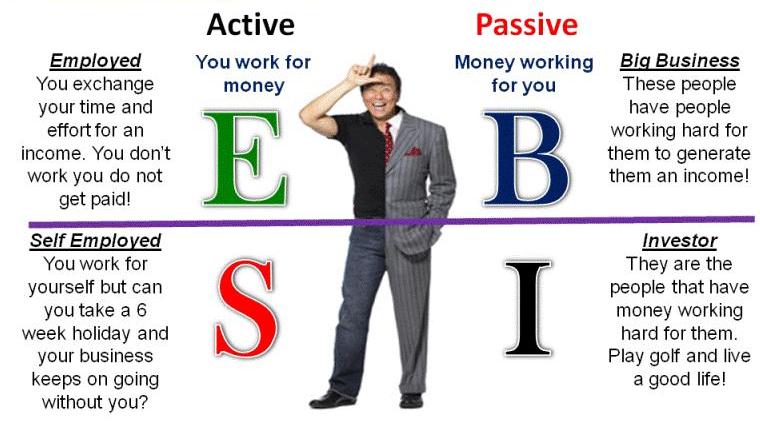

Employee’s work for money. Investors make money work for them.

Being employed feels great. I’m employed and extremely grateful to have a good paying job. But I realize that I can lose my job at anytime.

This is where people get tripped up. You’re not really looking for job security you’re looking for financial security. These are two totally different things. A job has the potential to assist you in becoming financially secure. But the way our institutions are set up secure jobs usually lead people down the path of massive debt.

Employee

Sure you know how to do your job well. You probably went to college. Your job probably gave you a bunch of training on how they expect you to do the job. Then you did the job for a couple of years and figured out the true best way to do it!

Have you invested that much time and interest in your finances?

It seems so obvious but many people don’t. Learning about managing your money is like a switch. Once you flip it all the opportunities around you that you couldn’t see in the dark come into view.

Life as an employee is cool but use your money to be an investor, not an average consumer. Remember assets are things that make you more money. This is where financial security starts.

Whether you work for a company or you’re self employed you’re still working for money. As long as you’re working for money you need to put just as much time and effort into figuring out how to make money work for you.

Business Owner

Being a business owner means you’re able to have other people working for you to make you money. You still have to provide vision for your business but your time is freed up to do other things. How do you know if you’re a business owner or self employed?

When you can walk away from your business for a year and it’s still making money and running efficiently then you’re a business owner. If not you’re self employed.

Business owners still have to know how to manage money. There are plenty of so called rich and successful people that end up in debt or living on the edge. It comes from a lack of knowledge about finance.

Investor

As an investor your money is coming in passively. You’ve created income streams from different investments. You could have stocks, real estate, companies, or all of the above. This is the ideal situation.

If your revenue from your investments allows you to live the lifestyle you want without working then that is financial freedom. Of course you may be passionate about your work and choose to continue. However, the point is that successful investors work because they choose to. Not because they fear the consequences of not working.

A common theme from employee to investor is managing money. This is why the American dream as it’s laid out in the beginning of this post doesn’t cut it. It doesn’t mention anything about managing your finances and making your money work for you.

One American dream that I like hearing is that you have the ability to make something out of nothing. Knowing how money works and how people (including yourself) work is really all you need to know.

That’s the main difference between wealthy and not wealthy. Of course there are systemic issues and flawed institutions but my opinion of the American dream means that you have the opportunity to make nothing into everything.

Do you think otherwise? I’d love to hear your reasoning! Just reach out and let me know!

Wealthy people know how both money and people work. People who aren’t wealthy know either money or people, or neither.

Wealthy vs. Not

Originally I was going to name this section wealthy vs. poor. Then I started thinking what does poor mean to me? Then what does poor mean to others?

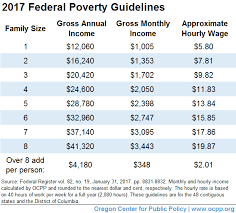

In 2017 the Federal Poverty Level in the 48 border states and DC ranged by household size. Let’s say you’re married and you have two kids. That’s a nice American dreamish family right?

For a family of four in 2017 you would be considered poor if your family brought in a maximum of $24,600 per year.

Most of us can’t imagine that situation. But if you are in that situation I’d be honored to talk with you and offer some no strings attached free guidance on the best path forward.

Poverty as defined by the federal government is a dire situation that requires all of our full attention. This is why I chose not to represent the false dichotomy of wealthy vs. poor. In reality there are a huge amount of places in between the two where most of us fall.

Getting Wealthy

If you find yourself in the hole every month don’t freak out! Remember the treading water scenario? This is the time that you need to focus your and your family’s efforts on digging out!

Put all of your monthly expense on a spread sheet or in a notebook and get your fruit ninja on!

There are so many unnecessary thing in your budget that you can easily cut and get on the fast track. Does your American dream mean you go home and have 500 channels to only watch 4 or 5? If so keep that 300 cable bill. If not cut it all together and just have internet.

Each month I spend $60 on internet and 12 bucks on Netflix.

What about your cell phone? You really don’t need all that data. Seriously you don’t. I have one of the top cell phone carriers and I pay less than $40 a month.

These are things that will take adjusting to but are absolutely necessary on your path to wealth. If your argument is that these things make you happy then you need to reevaluate where your happiness lies. Realize there is a huge difference between pleasure and happiness.

Sure it brings you pleasure to be able to jump on IG whenever you want during the day or night now matter where you are. But that doesn’t make you happy.

Pleasure is getting what you like, happiness is liking what you have.

Check out my previous post for more!

Wrap Up

Whatever your American dream is, make sure it’s your own. Always take the time to learn from other people but do your own comparative research. What I say in this post may not directly apply to you. But reading it may lead you to something that does speak to you directly.

I always preach this but it really is all about mindset. Start questioning more and accepting less. There is so much to learn but in a society where we conform to impress other conformists there is little emphasis on focusing your thoughts.

Money absolutely isn’t everything. But knowing how to manage your money and breaking away from paths that someone you don’t even know set for you isn’t everything either. Make your own path according to the standard that you feel are important.

Lastly I’d like to thank all the people that have reached out to me because of these writings. I’m so excited to help people with their passions because that’s my passion!

As always feel free to HMU, I’ll be around!