Now, one thing I tell everyone is learn about real estate. Repeat after me: real estate provides the highest returns, the greatest values, and the least risk.

~Armstrong Williams

Welcome back Gentrifanatics!

Lately there have been a lot of articles touting the fact that 90% of the world’s millionaires have been created by investing in real estate!

Not only is that a huge percentage, this represents the last two centuries of millionaires. That’s a long time for one wealth building strategy to be so consistent.

That is not a coincidence.

Here’s something we can all agree on: if you’re interested in making money, you’re interested in doing it while assuming the least amount of risk.

Face it, most of us want money. Even if we don’t admit, or realize it. It’s true, money doesn’t buy happiness. But what money does buy is time. With money you can spend the time you would have been using making money on something that you really care about.

Real estate has proven over time that it is the best way for the average person like me and you to make serious, long term money. Also real estate does this while exposing us to less risk compared to other investment strategies.

All risk is, is fear. We fear risk because we fear we’ll lose money. Losing money means we won’t be able to provide things for ourselves and our families. Not being able to provide boils all the way down to basic survival, life and death.

I’ve been to rock bottom financially. After my business went under I wasn’t able to provide for myself or my family. I had to sell things that I held dear to me in order to put food on the table.

In this edition of Gentrifanatic you’ll learn about why real estate is the best investment vehicle out there. Also you’ll learn about buying, holding, and selling real estate. A business that brought my bank account back from the dead!

Remember

People want to make money but they don’t want to risk what they already have. But to get something you’ve never had you have to do something you’ve never done.

Real Estate vs. Bitcoin and Stocks

You’re probably scared of real estate because you actually understand how you’ll potentially lose money.

That’s a good thing!

In the stock market, and especially in Bitcoin, you have no clue why you lost money. You can act like you do, but if you did then you wouldn’t have lost money in the first place.

Do you really know how Bitcoin mining, block chain, and derivatives really work, at their core?

Oh wait you do? Come work for me! Help a brother out and get me a crazy return on my money! 50cent said I didn’t go to Harvard but some people who work for me did.

I love that.

If you’re like the rest of us that stuff is like a foreign language. You can spend your life getting good at it but you’ll never know it as well as your native tongue.

Use Your Strengths

Play to your strengths, never your weaknesses.

You probably have like a level 3 knowledge of Bitcoin and stocks right now. Study hard and devote a bunch of time to it and you’ll probably get to a level 6 knowledge at best.

Our society is set up to where you probably have a level 6 knowledge of real estate already. Study hard and get to a level 9! Elite ranks! Again, play to your strengths. Go with what you know. Put your best foot forward. [insert similar cliche here].

You hear everyone talking about stocks and it sounds straight forward but it’s really not. Don’t get me wrong real estate takes a lot of learning but it’s real (hence the name).

Real estate is something you can see and understand. You understand how real estate works so the negative side scares you. That’s called risk avoidance. You’re so scared of the downside that you don’t even take a shot at the up side.

One advantage that stocks do have over real estate is liquidity.

If you buy a bad stock you can sell it and move on. If you buy a bad house you’re stuck with it. Thats why even though you understand the core idea of real estate you still need to educate yourself so you dont buy a bad deal. Real Estate investing should be treated like a business…because it is.

You may think you know how to put out fires, water on flames right?

Until you run into a gas fire and water makes the flames spread! You know the core idea of firefighting but to be a professional you need to educate yourself beyond the basics.

This is also true in real estate.

But there is so much more to understand if you want to be a profitable investor. Don’t just throw water on any fire and don’t just throw money into any random property.

I remember spending days getting good at Nintendo games. Why, because I wanted to win. Take time to learn the best way to make real money like you would anything you want to become good at.

Win!

At its core real estate is about buying, holding, and selling.

Buying

You’re at a point in your life when you’re ready to buy your first or next property.

Is this a house to live in or an investment to profit from?

Trick question. It’s both. Every single time you buy somewhere to live, it’s both.

Some may say, oh I’m buying my forever house so I’m willing to pay what I need to in order to get it. It’s a common mindset. Buying a house can be emotional for people. Let’s face it, this is the biggest purchase some people ever make!

I’m here to tell you that if you EVER plan to make money off of a house check your emotions at the door.

PERIOD!

Do I have to type the word period if I put an actual period at the end of the sentence? Anyway…

Once you or your significant other falls in love with a house you lost!

You’ll be willing to pay way more than you normally would and your real estate agent knows it. You can go into purchasing a home looking for a great place to live. But make sure it’s also a great deal because chances are one day you’ll move.

Maximize!

For this reason you should look into these factors when buying your first or fiftieth property so you can maximize your profit on the back end:

1. How much (dollar amount) repair does the home need if you were to rent it to a well qualified tenant or sell it to a picky buyer

- Calculate how much money you’d need to invest if you had to rent the property out (more on that later) or sell it to someone who doesn’t want to have to put any work into it (turnkey)

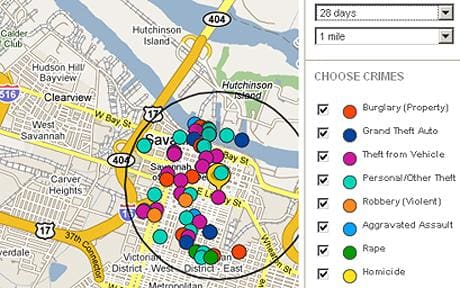

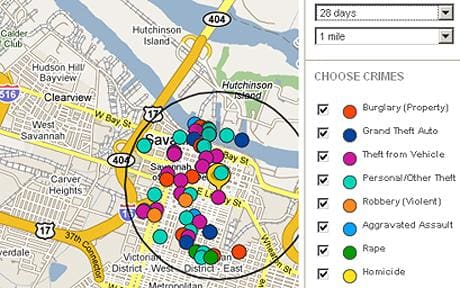

2. Is the surrounding area attractive to potential tenants and/or buyers

- For this check schools, crime, proximity to jobs

3. Am I purchasing in a sellers or a buyers market (buying in a sellers market leads to bidding situations where even if you win…you lose)

- Possibly the absolute best time to purchase a home is during the winter. Look at the houses that have been on the market all summer or longer and make your offer on them during or after the holidays. Late January and early February can be a sweet spot in most markets.

4. Taxes in the area

5. Proximity to transportation

6. Climate and weather trends

7. Demographics (what type of people live in the area

- Some areas are better suited for renters and young professionals while other areas are better suited for people starting a family. You need to know what type of people your area attracts before you buy.

In real estate a common saying is that you make your money when you buy the property, not when you sell it.

This is because if you take these things into serious consideration when you buy you set yourself up for a big return when you sell. If you make a poor choice when purchasing you’re pretty much at the mercy of the buyers when you sell it.

Unless you choose not to sell it!

Renting

Let’s say you don’t want to sell (good choice)!

Keep your options open. When you buy you may be thinking I’ll just sell and move on. I don’t know what I’m doing tomorrow let alone 5 years down the line (that’s a lie, but it sounded good for this section)!

Down the line you may change your mind! Put yourself in a great positon to sell but also a great positon to hold and rent out to a tenant.

Buy and hold means that you buy a property and keep it. This way you can rent it out to great tenants in the future and sell it when you’re ready (preferably after the value goes up a ton)!

In my opinion the buy and hold strategy in real estate is the best way to build wealth. I’m not that smart, but I listen to smart people, and what they’ve said totally works for me.

Here’s what’s amazing about buy and hold real estate. It’s called the trifecta!

-

Your renters are paying down your mortgage and building equity in your home.

-

Tax Benefits (also discussed in Why Post-Trump Tax Law Real Estate is Still a Good Investment)

-

Appreciation – this means that over the time that you hold onto your house there’s a good chance that it will go up in value assuming that you buy it correctly using the tips mentioned above.

These are the things you should look for to get the best return from a rental property.

Two Percent and One Percent Rule

A guidline commonly used by real estate investors is called the two percent rule. What this means is that the monthly rent you get from a property should be two percent of the purchase price. So if you pay $100k for a property then you should look to get $2k per month from your tenants.

This is ideal and if you find a deal that meets these rules then chances are it’s a good buy. It’s not a make or break rule but a good starting place when considering whether or not the property is a good deal.

Of course the one percent rule in that scenario would mean you get $1k per month on a property that you purchased for $100k. If you can get rents in the middle of these rules that’s a sweet spot (the higher the sweeter)!

Rehab Costs

Rehab costs mean how much it will cost you to get your property fixed up for a tenant.

Estimating these costs can really vary and should be done by a professional.

It really depends on what kind of shape the property that you’re buying is in. On my properties I always have a general contractor give me actual estimates. However, when considering whether or not to put an offer in I usually use either $25 per square foot or $50 per square foot depending on how the property looks.

If it’s in need of major repair you multiply $50 by the number of square feet in the house. Say the home is 1500 square feet: 1500 x $50 = $75k.

Now I know $75k sounds like a lot of money to fix a place up, and it is. But until you have a person who is ready to do the work give you an actual quote you need to be conservative in your estimates. So many things that you may not see if you’re unexperienced can make rehab costs sky rocket.

Better safe than sorry!

Operating Expenses

How much will it take you to run your property when you have tenants? How about when your property is vacant?

Here are some things you need to account for even if you don’t think you’ll need them:

- Property Management

- Vacancy

- Maintenance

- Repairs

- Capital Expenditures (Big items like a new roof, new HVAC, etc…)

Here are some things that are always a factor:

- Property Taxes

- Insurance

- Purchase costs (closing cost)

As always, don’t only do the things listed here! Look into it further and use your specific scenario. You can always reach out to me and I’ll be happy to help!

Selling

Sometimes its better to sell than hold. Holding on to your real estate is the best long term strategy. But sometimes you may have to implement a short term strategy to reach your long term goals!

Remember, real estate isn’t as liquid as stocks. You can’t sell it with one click of your mouse (yet)!

Under these scenarios it may be time to let go of your property:

- You want to trade up for a bigger property

- You lived in the house for 2 of the past 5 years and you want the tax free cash

- You want to get out of real estate because you lost your mind

When it’s time to sell there are some things to consider. Knowing the answers to these questions will help you maximize your win from the sale:

- How long have you owned the home?

- How long have you lived in the home?

- Where will you go?

- What time of year is it?

Recap

We talked about living in your home to avoid capital gains tax and 1031 exchanges but here’s a quick recap.

If you lived in your home 2 of the past 5 years when you sell you can avoid paying capital gains tax. This means you pocket all the profit. Considering you purchased the property well this profit should be pretty nice!

A 1031 exchange means that you can trade up for a bigger property and use the gains from your other property. In this exchange your taxes are deferred, and can be deferred indefinitely!

So where will you go? If you’re selling the house you’re living in give yourself enough time to make a great next purchase. Remember, it’s always and investment!

Earlier you heard that you should buy in the winter months. Guess when you should sell…spring! Buyers come out in the spring time and you’ll have more people coming to look at your property if you list it in the spring months.

Always work with a good real estate agent who understands investing and ideally owns their own properties!

Signing off

Gentrifanatics I wouldn’t steer you wrong! These are methods that I’ve used in my personal life. I have tenants and I invest in many types of properties. If you’re looking to get into this game your first move should be to talk to someone that’s doing it!

If you’re about success and progress I’d love to talk to you. Just HMU, I’ll be around!