I know the details of taxes better than anybody…better than the greatest CPA.

~Donald Trump

Hello again Gentrifanatics!

Yes! Owning a home is still a good thing!

There’s a lot of hype right now about Millennials and Generation Z. Hype around what they like and what they don’t like. What they will and won’t do.

It’s fascinating that most of the hype around Millennials and Generation Z’er’s comes from other sources. Most critiques on younger generations come from the older ones. I think that’s just how it works in life! Your music is real music and the new music is garbage!

Older generations these days are saying that home ownership isn’t on the younger generations radar. This isn’t, and more importantly, shouldn’t be the case. Generation X’er’s and even some Baby Boomers seem to be steering younger people away from owning a home.

Personally, I purchased my first home in my 20’s and have purchased several after that. I still own all of my homes and I can attest that real estate is a vital investment to have in your portfolio. It’s put me in a great financial position. More importantly, it’s been a great teacher when it comes to managing risk.

In this edition you’re going to learn 5 reasons why home ownership is still a great wealth generation tool. With the President’s new tax laws and uncertainty in the market many are hesitant to dabble in real estate. You will see why despite the times it’s still a great idea to invest wisely in real estate.

1. Tax Benefits

Talking taxes is usually either super boring or super scary! But don’t think about it as taxes. Think about it as money on the table.

Whether you’re buying your 1st home or your 50th; real estate related tax deductions are your friend!

Three really important tax breaks when you own a home are:

- Mortgage Interest Deductions

- Property Tax Deductions

- Capital Gains

First let’s break it down. A tax deduction is a reduction in the amount of income that the government can tax you on. Why does this matter?

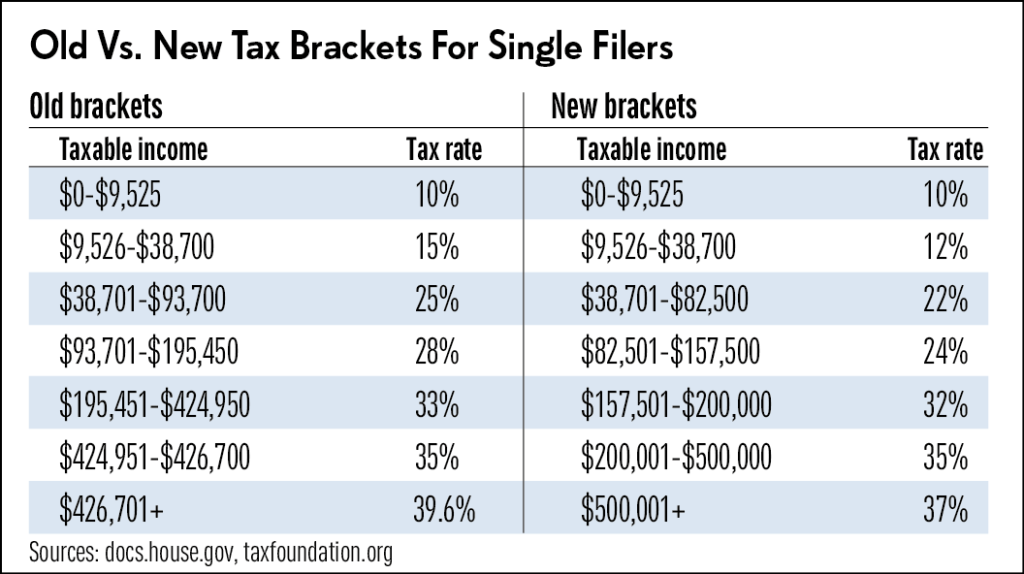

Let’s say you have a good paying job and make $85k a year. According to Trump’s new tax law you’ll have to pay Uncle Sam 24% of that $85k (thats $20,400 in taxes)! Now, if you have a deduction of $5,000 then that brings your taxable income down to $80k.

Be clear, you still made $85k at your job. However, because of your tax deduction the government can only tax $80k of your income. With the 2018 tax law that puts you in a lower tax bracket. Now the tax man can only take 22% of that $80k (that’s $17,600 in taxes).

You realize that this is an oversimplified example but it hammers the point home. Tax deductions are good!

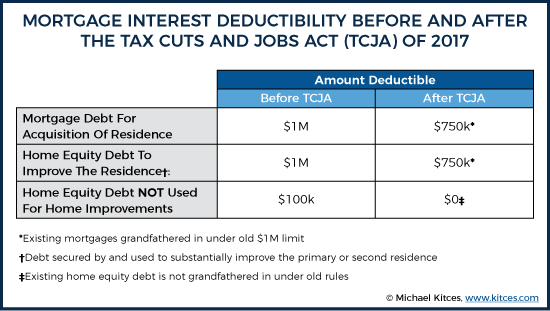

Mortgage Interest Deductions

When you own a home you can deduct up to $750k in mortgage interest every year. If you’re at the level where you’re paying that much in interest can I please borrow some money?!?!

Here’s an easy what if scenario. You own a $180k house and you pay a 4% interest rate on your loan. Say at the end of the year you paid $5,000 in interest. That means you can deduct all of that $5,000 from your $85k in taxable income brining you down to $80k.

On the flip side, if you’re renting you’re missing out on that money. Of course you don’t pay interest on rent but rents can be much higher than mortgages. Also you don’t own the place you’re renting. So if you’re renting and making $85k a year you need to pay taxes on that full amount unless you have other deductions.

Property Tax Deductions

Now you know what a deduction can do for your wallet. Just apply this same logic to the amount of property tax you pay on a home. When it comes to property tax, according to the new tax law you can only deduct up to $10,000.

This is a significant change and one not too many people are happy about. If you live in an area with high property tax you could end up paying a lot more going forward. Bottom line is property taxes you pay can reduce your taxable income by up to $10,000.

Capital Gains

All kinds of gains…all kinds!

These types of gains are the profit that you make from the sale of your property. Capital gains tax is just what it sounds like. A tax on that gain you made when you sold your property. You definitely want to avoid this if possible!

Here’s how it works.

You buy a house. You live in the house for at least two years and then sell it. If the house went up in value you will get a chunk of money back in profit from the sale. Currently the law says that if you lived in the house two of the last five years they you keep the profits from the sale up to $250k!

This will apply to most people when they sell unless you keep your property as a rental. We’ll get into that later.

2. Equity

Equity, put simply, is how much of something is yours.

Like if supermodel Jourdan Dunn and I go half on a baby, that beautiful love child is 50% mine and 50% hers.

To put it in more realistic terms let’s say you buy a house for $100k. Then over the course of 2 years you pay down your mortgage to $80k. You’ve invested $20k so now you have 20% equity in that house (assuming it’s still worth $100k). Another way to put it is that you own 20% of the house (oh and btw, the bank still owns 80%)!

What’s beneficial about equity is that it can really boost your wealth over time. Even if you only buy one house in your lifetime! If you own that house and make the mortgage payments every month you’re golden! You may look up 20 years down the line and see that you’ve put $80k into that $100k house. Except now the property value has gone up to $200k!

This means that you only owe $20k on the property you have $180k in equity! Looking back at the capital gains section, even if you sold your house at that point you would get to keep all that $180k in profit and pay no taxes!

Of course we all know what happened in 2007-2008 with the real estate crash. I’m not gonna spend too much time on that because if you’re over leveraged in anything there’s a risk of losing your shirt. What’s really important is that you live below your means and make smart choices with money.

3. Predictable Costs

Assuming you get a fixed rate mortgage (which you must) your payment won’t significantly change. When you rent from someone over the long term it’s inevitable that rent prices will go up.

Now with fixed rate mortgages, yes your property taxes can go up. You have to pay for things when they break etc…but in the long term what you pay is steady. You don’t need to worry about renewing a lease and the owner raising the rent on you.

This is another reason that it’s important to be diligent when you buy. Things like adjustable interest rates and high home owner association fees are all things that can significantly inflate your payment.

That’s bad.

Today everyone is talking about the gig economy. They say that as millennials and Generation Z’er’s you don’t want to live in one place your whole life. They say you’re not going to want to purchase a home.

To that I say…how do they know? Everyone is different. I get it, trends lean one way. But trends are a dangerous thing to place your bet on!

As younger people we may want to move around a bit more. This doesn’t mean that we don’t want to build wealth! You want to get as many passive income streams as you can!

Rental properties offer the best of both worlds.

4. Renting Out Your Property

This topic excites me because it’s my (vegan) bread and butter.

Having purchased and rented out several properties since my 20’s I know the wealth generation advantages that this strategy holds.

All that rehabbing and flipping houses stuff…reality TV can keep it! If you’re really looking for longterm wealth in real estate, buy and hold is the way to go!

Owning a rental property has several advantages. Some obvious, and some not as much. For example.

Cash Flow

If you buy your house right, when you rent it out it will cash flow. Cash flow is the income you have after your expenses. Making sure you have a positive cash flow in a rental property is essential.

Here’s an example for you:

You own that $100k house and your mortgage is $300 per month.

After a couple years you decide to move to another house but you keep this house and rent it out. Say you can get $600 per month in rent.

Be careful! This doesn’t mean that you’re making $300 per month!

Maybe it costs you $75 a month in maintenance and you set $75 a month aside in reserve funds (important). With those expenses paid you now have $150 left per month in positive cash flow!

There’s a guide in the rental world called the 2 percent rule. The amount of rent you get from a property should be 2 percent or more of the cost of the property. This doesn’t mean that if you don’t get 2 percent that it’s not a good deal. It just means that aiming for 2 percent is a good rule of thumb!

So with your $100k house 2 percent would be $2,000. If you’re not able to get $2,000 in rent per month you should really check your expenses and make sure you’re cash flow positive!

One thing that I’ll mention quickly is Airbnb. I’ll get into this more in future posts but there’s a potential to make a lot of money depending on your local laws. In a nutshell Airbnb lets you rent out part or all of your home on a temporary basis (like a bed ‘n’ breakfast). Renting this way has the potential to multiply your cash flow significantly.

Equity (again)

Back to equity! When you have a rental property your residents are building your equity for you. This is why you should treat your residents like the superstars that they are!

Yes you’re providing them clean, safe, comfortable housing at a fair price. Remember, they are helping you build wealth with every single rental payment.

To your $100k house, with the $300 mortgage, that you rent for $600 a month.

Your residents are paying your $300 mortgage each month (plus and extra $300). They make the payments but you build the equity. As they pay you own more and more of a percentage of your home.

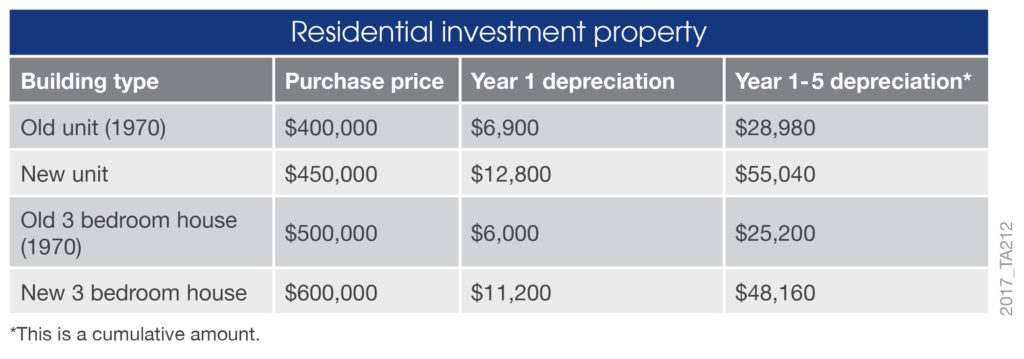

Depreciation

Owning rental properties comes with significant tax deductions.

Specifically, the depreciation that you can claim each year can potentially save you thousands. Look at it this way:

Moving on up to a $200k house. Let’s say that the building itself (excluding the land) is worth $125k. The IRS says your house has 27.5 years of useful life. This means that your depreciation each year is $4,545 ($125k/27.5 years). When you multiply this by your marginal tax rate (another discussion) you’re saving $1,000 – $2,000 a year!

Sounds a little technical but do your research. Don’t take my word for it!

Remember the capital gains conversation we had? Now say you didn’t live in your property 2 of the last 5 years because you were renting it out. What do you do when you go to sell?

Well if you sell the house after owning it for a while and not living there you’ll have to pay capital gains tax. The amount depends on several things but usually it will be 15 percent of your profit from the sale.

Unless…

5. Trading up

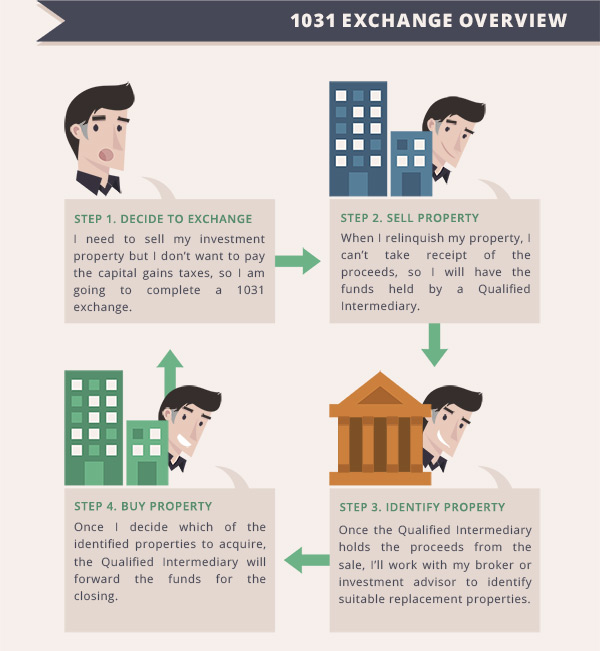

I want to talk briefly about what’s called a 1031 exchange.

This is definitely an advanced topic but it’s good to keep in the back of your mind.

If you’ve owned an investment (rental) property for a while, and you want to sell it one of two things will happen:

- You pay capital gains tax

- You do a 1031 exchange

A 1031 exchange is when you sell your rental property and defer paying any capital gains tax. This tax is only deferred if you buy an investment property similar to the one you sold, but better. You only have a small window to do this in and there are several rules surrounding it. However, if you can pull it off you can use all of your profit from your previous investment without paying any taxes at that time.

Technically you can do this over and over again until you die! Then when you die if you pass properties on to your kids they won’t need to pay any taxes (if you do it right). Here’s a quick example:

You sell your rental property and make $100k. You have two choices:

- Pay capital gains tax ($100k x 15% = $15k)

- 1031 Exchange

If you do a 1031 exchange you can take that $100k and buy other investment properties. You can use it to put a down payment on a larger property or put several down payments on several smaller properties. Ultimately your return on investment should be better than it was with the property that you traded up from.

Definitely research this yourself and consult a professional to walk you through it. If you want to run some things by me I’m always happy to help!

Wrapping up

From everything you’ve read here I hope you can see why owning real estate is still a great idea. Some of you may not be at the place where you can buy yet but when you get there you’ll be armed with the knowledge to make a great purchase.

When I bought my first place I had no clue what to look for! When I rented out my first place I had no clue what I was doing! This is why I want you to benefit from all the things I did right and more importantly the things I did wrong!

For more on taxes check out my previous post 4 Brilliant Ways to Invest Your Tax Refund Money in 2018!

I love talking about this stuff so please feel free to reach out! I’ll be around to help answer any questions you may have or even just lend an ear to bounce your ideas off of!