It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you

keep it for.

— Robert Kiyosaki

Welcome Gentrifanatics!

If you’ve ever tried saving money for something or just saving money in general you know how boring it is!

In the past I thought that saving was the only way to get a lot of money! I put all my extra money into my savings account and waited for it to turn into a million dollars!

My banks interest rate was super low so I would get a few cents every now and then but that’s it.

I didn’t know much about investing other than that it was risky. My fear on investing held me back for years. Years that I could have been building wealth!

When I finally got a little smarter I invested in the stock market through my jobs 401k retirement plan. Even though it was better than my savings account I was still just throwing money into the account and I really had no control over whether or not I made or lost money.

Investing in things I didn’t understand made me think about what money really was. Looking around at what my family and friends were doing I figured out a pretty common formula.

1. Go to school

2. Get a good job

3. Start saving money for retirement

4. Retire

5. Die

My dislike for this system made me seek out a better way.

Related Posts:

Why Real Estate Can Beat Bitcoin and the Stock Market in a Fist Fight

4 Easy Ideas in 2018 To Help You Cure the “Working For Someone Else Until You Die” Syndrome

In this post you’ll hear about why just saving money is a fool’s errand! You’ll also learn why many of the aspects of money that you take for granted aren’t real.

Money Isn’t Real

Ok, I know you’ve heard this before. Yes money can get you things so technically it’s real. But what I mean by this is that money, in terms of dollars, can be, and is often, manipulated by those in power.

Bretton Woods Agreement

Every dollar that the U.S. prints will be tied to a physical amount of gold. This is the main take away you

should get from the 1944 Bretton Woods Agreement.

For every dollar in your wallet there was a dollars worth of gold in a vault somewhere. Spending that dollar meant you were notionally spending that gold.

That’s how it was for the next 27 years, until…

Nixon Shock

President Richard Nixon removed the gold standard established by the Bretton Woods Agreement in 1971.

What this meant was that your dollars were no longer backed by gold.

So what did they stand for?

Well, pretty much nothing. After that money was just a system agreed upon by everyone. After the gold standard was removed money really had no physical value unless people allowed it to in their mind.

Before 1971 every dollar you saved was like saving gold. After 1971 every dollar you saved ultimately meant that you were at the mercy of manipulation by world events.

Of course the U.S. government had to secure their currency in some way…

Petrodollar

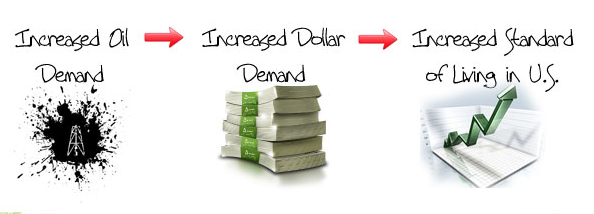

Since 1975, anyone that buys oil from Saudi Arabia has to do so in U.S. dollars. This is what’s known as the petrodollar.

This is the idea that the U.S. government came up with to create a demand for the U.S. dollar.

While it started with Saudi Arabia the petrodollar also extends to other Organization of Petroleum Exporting Countries (OPEC).

These countries are Iran, Iraq, Kuwait, Saudi Arabia, Venezuela, Qatar, Indonesia , Libya, the United Arab Emirates, Algeria, Nigeria, Ecuador, Gabon, and Angola.

When these countries decide to allow people to buy their oil in a currency other than the U.S. dollar the legitimacy of the U.S. dollar gets weaker.

Saving your money means that you trust the politicians of the world with your future.

Fiat Money

What fiat money means is that a government prints a currency that isn’t backed by a commodity (such as gold).

When you save fiat money you run the risk of it becoming worthless. If people lose faith in the U.S. you could have a million dollars in the bank and it would be meaningless.

Think about it.

In prison snacks and cigarettes become currency.

Money is whatever a particular group deems to be valuable. Nothing more.

This is why even if you become rich by saving (which you won’t) you can still lose it all and you have no control over whether or not that happens.

Hyperinflation

When a bunch of money is being printed and it’s not supported by the value of U.S. goods and services then you have hyperinflation.

In a hyperinflation scenario your money becomes worthless.

You may think this sounds impossible but it’s happened to other countries 55 times in the 20th century.

Why Saving Will Never Work

Do you know what the bank does with your money when you deposit it?

It makes money off of your money! That’s what you should be doing!

For every $100 you put in the bank, the bank can turn around and lend out $90 of that money! It’s called fractional reserve banking.

If something crazy happens and you need to pull all of your money out do you think that giving you your money will be the banks priority?

Of course they say it will always be there but think worst case scenario! The banks will act in their own interest.

Interest vs. Inflation

Real quick:

Interest is what the bank pays you to keep your money there.

Inflation is how much the price of goods and services are going up.

Currently the U.S. inflation rate is about 2%

Average interest rates on savings accounts are about 1%

So prices are going up at a higher percentage than the money in your savings account.

You get 1% return for your money but you have to pay 2% on things you use your money for.

By keeping your money in a savings account you’re really losing 1% or more of your money!

What Should You Do?

Stop saving your money and invest in something real.

Buy rental properties, buy companies, create a business. Add value to the world.

If you can add value to the world by investing in the stock market or bitcoin do that.

I know I can’t but it doesn’t mean you don’t know a way.

What I can do is tell you things that are helping me on my lifelong journey in the hopes that these things might help you on your own journey.

Take Aways

Stop saving.

Start investing.

Provide value.

Think for yourself.

I’ll always be here to help, just an email away!